Featured

Table of Contents

To certify, a meal should be bought throughout a business journey or shared with an organization affiliate. What's the distinction between a vacation and a service journey? In order to qualify as company: Your journey should take you outside your tax home.

Practice Software for Mental Health Professionals

If you are away for 4 days, and you invest 3 of those days at a meeting, and the 4th day taking in the sights, it counts as a service journey. Reverse thatspend 3 days taking in the sights, and one day at a conferenceand it's not a company trip.

You require to be able to prove the trip was planned in breakthrough. Therapist Marketing Plan Guide. The IRS wishes to prevent having organization owners add professional tasks to entertainment trips in order to turn them right into company costs at the last moment. Preparing a composed schedule and itinerary, and scheduling transport and accommodations well ahead of time, helps to reveal the trip was mainly service related

When making use of the mileage rate, you don't consist of any kind of various other expensessuch as oil modifications or regular repair and maintenance. The only added vehicle expenses you can subtract are car parking costs and tolls. If this is your initial year owning your vehicle, you need to determine your deduction using the mileage price.

Private Practice Coaching for Clinicians 2025

Some extra education and learning expenses you can deduct: Guidance costsBooks, journals, and trade magazines connected to your fieldLearning products (stationery, note-taking applications, etc)Review more regarding subtracting education expenditures. resource If you exercise in a workplace outside your home, the expense of lease is totally deductible. The price of energies (warmth, water, electrical power, internet, phone) is also insurance deductible.

This is called the office reduction. In order to get approved for this deduction, you have to use your home office: Solely, implying you have a separate area where you function. This can be a separate space in your home, or a section of a room. Your key use the location should be for work.

Launching a Clinical Practice in Today

If you use your desk on arbitrary events to catch up on progression notes, the area does not qualify as an office. If you sit at it to compose development notes everyday of the week, it will. With precedence, suggesting it's your number one location of business. For circumstances, you don't invest 90% of your functioning hours at a various office, then use your extra area for take-home job.

There are two ways to do so: the office normal approach and the office simplified approach. It's good to experiment with both on paper initially. Depending on your circumstances, one technique may lead to a larger tax write-off than the various other. To compute your home workplace reduction utilizing the normal method, initial establish the square footage of your office.

Learn more about whether individual therapy is tax insurance deductible for specialists. If you use Square, Stripe, or similar solutions to collect payments from clients, those charges are 100% tax obligation insurance deductible. This relates to both level regular monthly charges you pay to use these services, and any kind of portions of your income they gather.

- Wikipedia - Psychotherapy

- American Psychological Association - Practice Research

- Journal of Counseling Psychology

The registration costs of software application you use for scheduling customer visits is 100% tax obligation deductible. Is the cost of any software application you make use of to invoice clients or offer them with receipts.

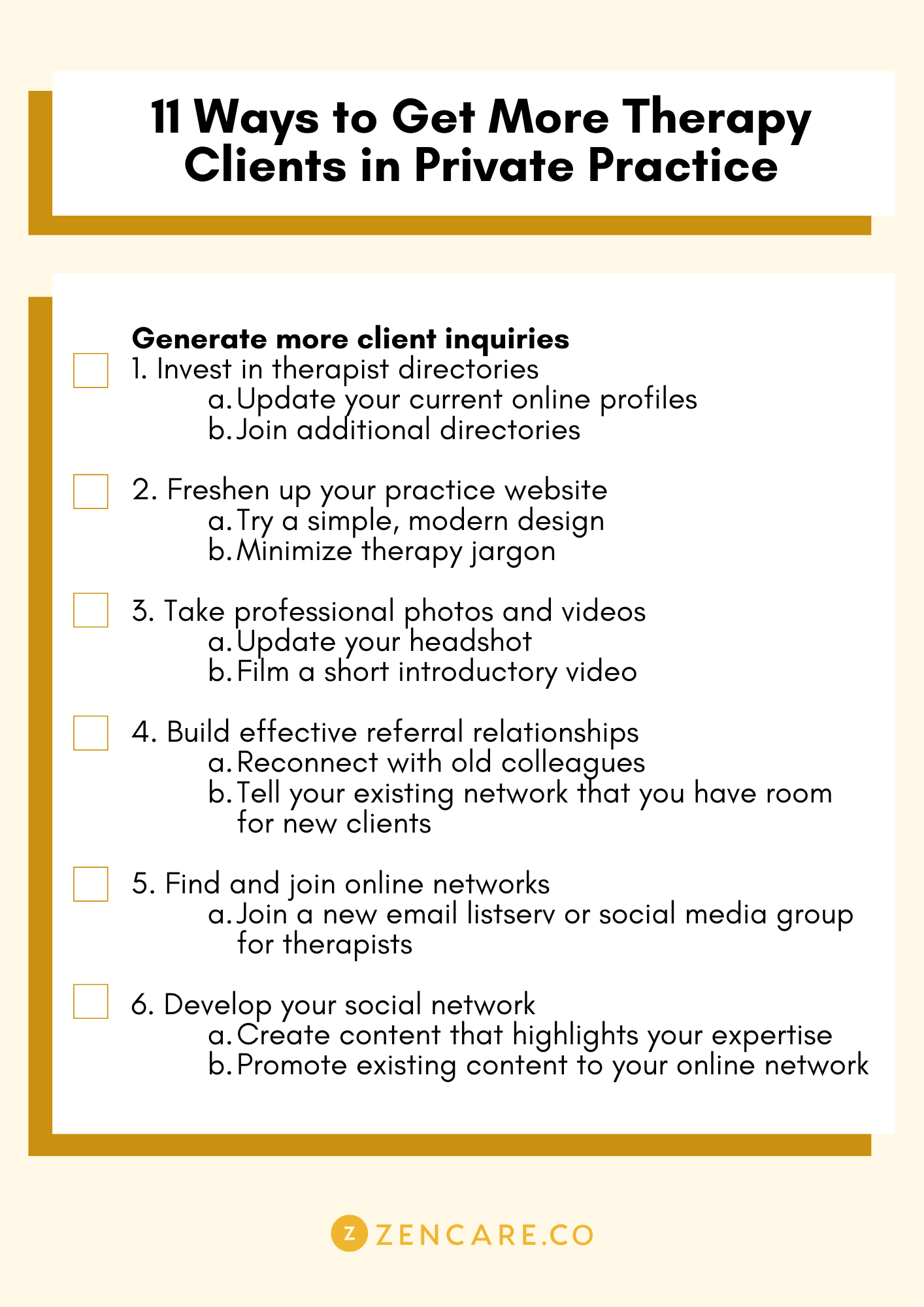

Finding More Therapy Clients

This insurance plan secures your technique from cases of negligence or negligence in the making of specialist services. Because it is thought about a regular and needed overhead for specialists, specialist responsibility insurance coverage is normally taken into consideration tax deductible (Starting a Clinical Practice in This Year). This suggests that you have the ability to cross out the cost of your insurance coverage costs on your income tax return

Like specialist responsibility insurance policy, the price of general liability insurance coverage costs are tax insurance deductible and can be asserted as a deduction on your tax return. Make sure to record all settlements made in the direction of your plan, as this information will be crucial when filing your tax obligations at the beginning of the year.

If you pay over $600 in passion during the training course of the year, you can assert the expenditure on your income tax return. Find out more from our overview to the. The QBI deduction lets you cross out as much as 20% of your income, and many solo specialists receive it.

Practice Software for Mental Health Professionals

In order to sustain my fellow clinicians in the globe, I chose to create an extensive list that covers a few key areas. Technology for Mental Health Practices. You've found your workplace area, selected your practice name, and saw to it your name drops within the legal standards of your state needs. You have actually submitted your DBA (Operating As), opened a business checking account, probably incorporated your organization, and published up your calling card

I eventually expanded tired of feeling like I had to go to the twenty year old people in my life to walk me via my modern technology obstacles. I determined to spend in some fundamental website and tech training to make sure that I felt much more certain. Nowadays, while I am much from being a technology specialist, I can hold my very own simply great.

Latest Posts

When Parenthood Doesn't Feeling Like You Idea It Would Certainly: One Mama's Journey to Finding the Right Assistance

Digital Marketing for Clinicians

Mental Health Marketing Plan Tips